27+ rule of thumb for mortgage

Web The 70 rule can help flippers when theyre scouring real estate listings for potential investment opportunities. Ad See what your estimated monthly payment would be with the VA Loan.

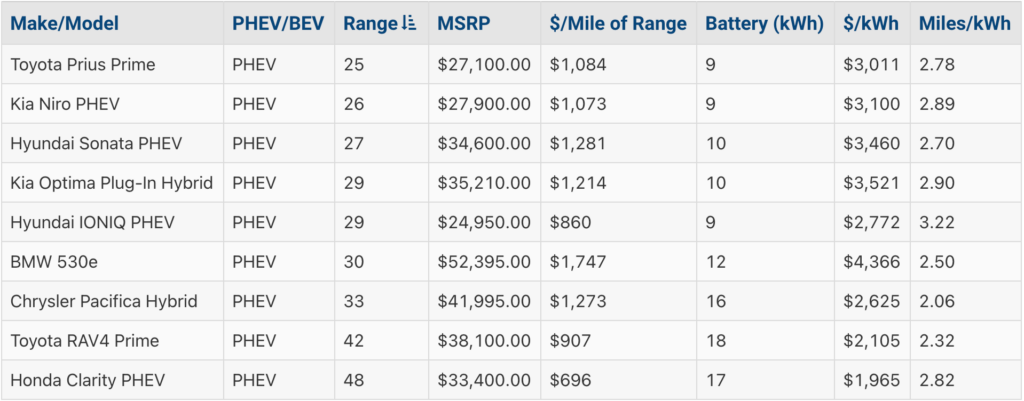

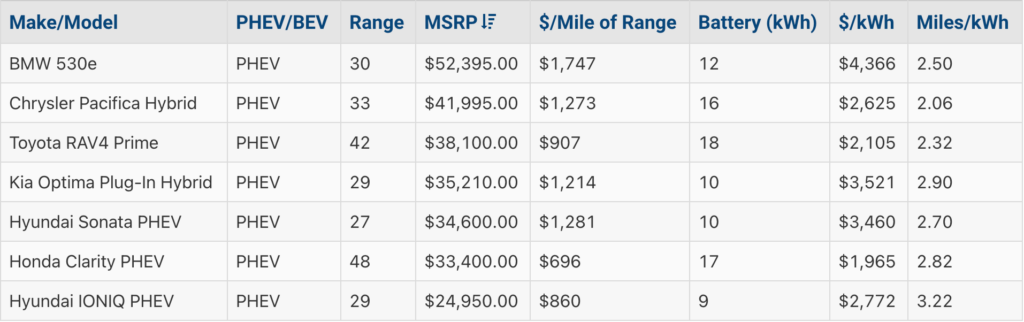

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

Applying the 502030 rule would give them a monthly budget of.

. How to shop for the best mortgage rate. If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage. Web As mentioned above the mortgage affordability rule of thumb from most mortgage lenders is that the mortgage repayments should not take more than 35 of.

Another rule of thumb is the 28 36 rule. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

For example if you annual income is 30000 you might be able to afford a. Web A 30-year fixed-rate mortgage at 35 interest and 3 down would result in a monthly principal and interest payment of 1088. Putting 5 down drops your monthly payment by only 22 but 10 down.

Apply Online To Enjoy A Service. Web The 28 rule. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

But thats not the only factor you should consider. Web The rule of thumb is that its best to refinance when interest rates are at least 1 lower than your current rate. Receive 1000 Off On Pre-Approved Loans.

In this scenario once you spend 28 on your mortgage payment you may still have an additional 8 of your. Lenders prefer you spend 28 or less of your gross monthly income on. Web To calculate how much house can I afford one rule of thumb is the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home.

30000 X 3 90000. Web Rates as of Feb. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You.

Web Consider an individual who takes home 5000 a month. Web 2 hours agoUsing the 1 percent rule youd need to bring in at least 2500 per month total or 1250 per unit to cover your costs. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web According to Ramsey your monthly housing expenses should never be higher than 25 of your monthly after-tax income. Mortgage of 60000 to 75000. Save Real Money Today.

The size of your mortgage Loan Balance The difference between your current rate and the proposed rate Delta The. Web The Rule of Thumb for refinancing depends on. The point of the 2010 rule of thumb is to get a handle on your debt in relation to your annual and monthly take-home pay.

Web How can I calculate how much mortgage I can afford. 300000 X 2 60 000. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Highest Satisfaction for Mortgage Origination. As a rule of thumb many people estimate they are able to afford a mortgage of 2 to 3 times their. There is no best loan term as a rule of thumb.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. 50 for mandatory expenses.

Now lets say youre looking at a 150000. Web Whats The Purpose Of The 2010 Rule. Web The 28 36 Rule.

Basically the rule says real estate investors should. So if you take home 5000 a month after. It all depends on your goals and your current.

One common rule of thumb is that your. Web Money experts use a lot of general guidance to help people make better financial decisions and its no different with mortgage loans.

:max_bytes(150000):strip_icc()/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What Is The Quarterly Settlement Of Funds Quora

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

27 Credit Repair Tips And Resources Boost Your Credit Score In 2023

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Hack Your Way To Freedom The Psychology Of Saving Money Woke Money Hero Skillshare

How Much House Can You Afford Calculator Cnet Cnet

Income To Mortgage Ratio What Should Yours Be Moneyunder30

10 Beliefs And Financial Decisions That Keep You Broke

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Market Timing Should You Buy A House Now Or Wait

27 Business Ideas In Kollam For 2023 Updated List